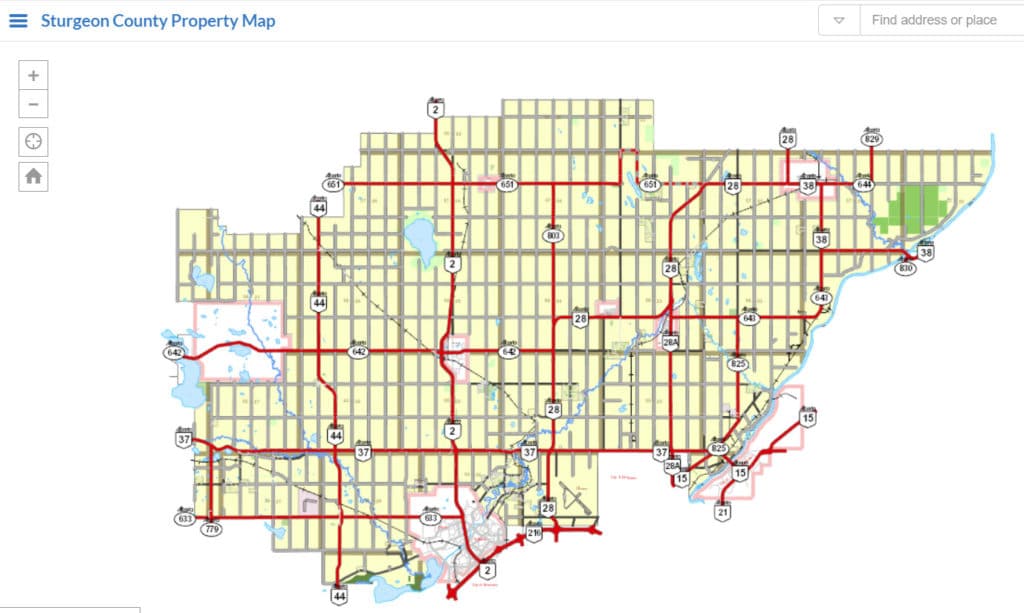

Property Assessment Map

To find your current property assessment, visit the interactive Property Assessment Map.

Property assessment places a dollar value on property in order to calculate taxation.

Provincial legislation requires that:

- Sturgeon County prepares an annual assessment of all residential and non-residential properties. The assessments must be prepared using mass appraisal, meet provincial legislated standards, and represent the fee simple value of the property. The valuation date is July 1 of the year preceding the current tax year. The real estate market establishes the market value of your property; assessors simply measure it.

- The condition of your property is recorded. The condition date is December 31st of the year preceding the tax year. The condition of your property is determined by local assessors from property inspections and property information requests sent out and received from residents.

Request for Information Online Survey

Having trouble viewing the form?

Open in new window.

Understanding Your Property Assessment

Learn more about what characteristics such as location, age, size, quality of construction, and site influences are all considered in your property’s assessed value.

Assessed Value

Assessed values consider the property size, age, construction quality, and condition of any structures on the property. Your use of the property determines the tax rate applicable to your property (residential/non-residential, farm, Machinery & equipment). Since no two properties are alike, your property may be valued and taxed differently than your neighbour’s property.

Rural farm properties enjoy some provincially regulated exemptions. Exemptions are based on the amount of farmland owned and how buildings are used for farming operations. These exemptions are not automatically applied and should be discussed with your local assessor.

The details of your property are used to calculate your property’s assessed value, and correspondingly this value is used to calculate your property taxes. It is important to review your property assessment details to ensure they are accurate. You can report any discrepancies in your property details to your assessor.

For more information on how property tax is calculated visit, Property Taxes.

Supplementary Assessment

Supplementary assessments only apply when new construction is completed or occupied during the tax calendar year. The purpose of supplementary assessments is to capture the value gained by a property when new improvements are added, or their construction is completed after the December 31 condition date. The value gained from new improvements, or construction getting completed was not included in your annual tax notice and is thus applied on a prorated basis when it gets completed.

Supplementary assessments contribute towards equitable distribution of the cost for municipal services like fire and protective services and road maintenance.

Supplementary Assessment notices are sent in October each year. To avoid penalties, the tax bill must be paid on or before the due date shown. Visit property tax payment for options on how to pay, including the option to join the monthly Tax Instalment Payment Plan (TIPP).

Local Improvement Charges

A local improvement charge is a tax applied to properties that will benefit from improvements, such as new sewer lines or sidewalks, in a specific area. This tax pays for the capital costs of the improvements. It is different from a municipal tax because it only applies to properties that benefit from the improvements, and it is only charged for a specific time. This program can be initiated by the property owners and managed by the municipality. Currently, Sturgeon County has one community with a local improvement levy, the Riviere Qui Barre San Sewer (Bylaw 1353-15).

Have a Question? Ask an Assessor

Submit your assessment question(s) using our online tool and an assessor will contact you within two business days.