Sturgeon County is committed to being globally competitive. Enhance your profitability by taking advantage of our investment incentives.

Energy Value Chain Incentive

Alberta’s Industrial Heartland is poised to attract up to $30 billion in new capital investments. Our highly competitive incentive program offers municipal tax exemptions between 1.5 and 2.5 per cent of eligible project capital costs for energy value chain projects.

Overview

Sturgeon County is a proud and founding member of Alberta’s Industrial Heartland Association (AIHA). The Heartland is Canada’s largest hydrocarbon processing region and is a world-class location for the development of major industrial projects in the energy and petrochemical value chains. The Heartland is responsible for 43 per cent of Canada’s annual basic chemical manufacturing output and has a geographic footprint of 582 square kilometres (225 square miles). Sturgeon County’s portion of the Heartland is roughly 100 square kilometres.

Incentive Details

This incentive is supported by the Heartland Incentive Bylaw.

New construction and expansion projects in Sturgeon County’s portion of the Heartland could be eligible for a municipal tax exemption between 1.5 and 2.5 per cent of eligible project capital costs.

A valuable competitive differentiator of Sturgeon County’s incentive is the focus on environmental, social and governance (ESG) criteria. Projects demonstrating defined ESG criteria could access municipal tax exemptions of 2.5 per cent of eligible capital costs, while other projects could access exemptions of 1.5 per cent.

Sturgeon County’s tax exemption incentive is complementary to the Alberta Petrochemical Incentive Program (APIP), which offers grants for eligible facilities valued at up to 12 per cent of eligible capital costs.

Incentive Eligibility

To be eligible, a project must meet the following criteria:

- Be physically located within Sturgeon County’s portion of Alberta’s Industrial Heartland and within the County’s I5 – Heavy Industrial District

- Be an energy value chain project or associated infrastructure

- Be either a new construction or expansion project

- Have total eligible capital costs greater than $50 million CAD

- Employ at least 250 workers during construction or 15 permanent workers once operational

- Meet additional legal and financial requirements as outlined in the Heartland Incentive Bylaw

Application Process

We encourage interested applicants to contact our Economic Innovation and Growth team to discuss your eligibility and the application process.

Value-Added Agriculture Incentive

This incentive is supported by the Major Investment Incentive Bylaw.

New construction and expansions of value-added agricultural projects in Sturgeon County could be eligible for municipal tax exemptions between 1.5 and two per cent of eligible project capital costs.

Projects demonstrating defined ESG criteria could access municipal tax exemptions of two per cent of eligible capital costs, while other projects could access exemptions of 1.5 per cent.

The benefit term length will apply for a maximum of 10 years, with a maximum 80 per cent exemption on the incremental increase in the annual property taxes.

Incentive Eligibility

To be eligible, a project must meet the following criteria:

- Be located in Sturgeon County

- Be a value-added agriculture project

- Be either a new construction or expansion project

- Have total eligible capital costs greater than $20 million CAD

- Employ at least 50 workers during construction or 30 workers when operational

Application Process

Information about applications will be available in early 2023.

Alberta Agri-processing Investment Tax Credit

Additionally, you may be eligible for the Alberta Agri-processing Investment Tax Credit. This provides a 12 per cent non-refundable tax credit against eligible capital expenditures for corporations investing at least $10 million to build or expand agri-processing facilities in Alberta.

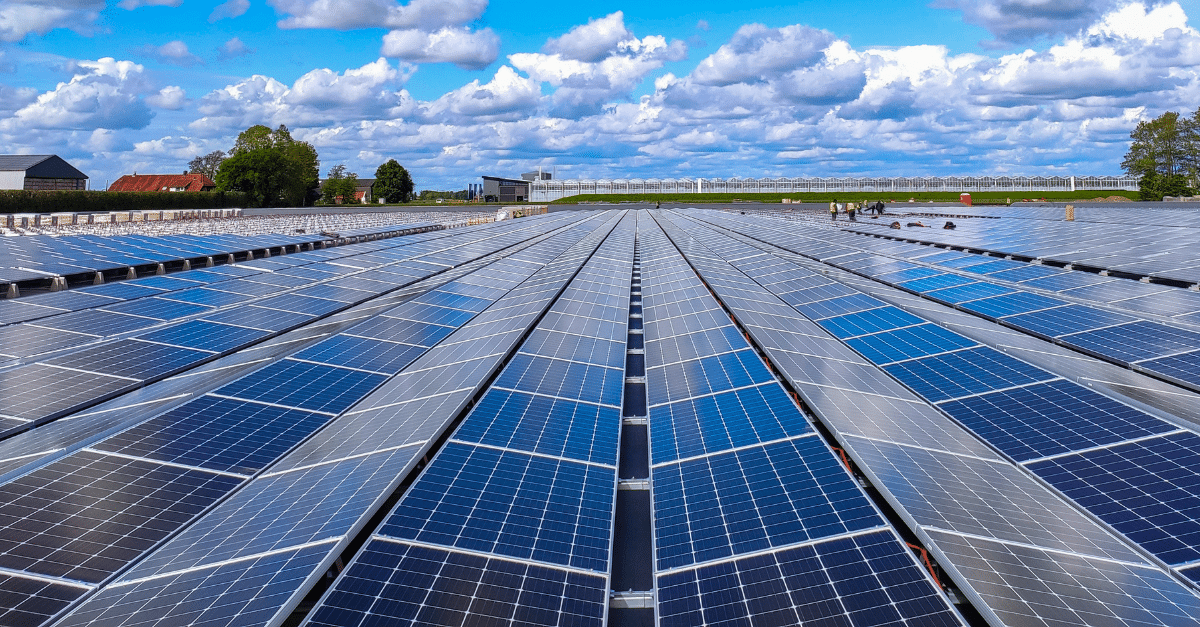

Solar Power Production Incentive

This incentive is supported by the Major Investment Incentive Bylaw.

New construction and expansions of solar power production projects in Sturgeon County’s portion of the Heartland could be eligible for municipal tax exemptions of one per cent of eligible project capital costs.

The benefit term length will apply for a maximum of 10 years, with a maximum 80 per cent exemption on the incremental increase in the annual property taxes.

Incentive Eligibility

To be eligible, a project must meet the following criteria:

- Be located in Sturgeon County’s portion of Alberta’s Industrial Heartland

- Be a solar power production project

- Be either a new construction or expansion project

- Have total eligible capital costs greater than $200 million CAD

- Employ at least 50 workers during construction or 30 workers when operational