Property tax payments are due June 28, 2024.

Sturgeon County distributes property assessment and tax notices in late May every year. Property owners are to pay their taxes by the last business day in June each year to avoid late-payment penalties in accordance with Property Tax Penalty Bylaw.

At the April 9, 2024, meeting, Sturgeon County Council approved the 2024 Tax Rate Bylaw with a 1.37 per cent municipal tax rate increase. This means a property valued at $500,000 will pay $26 more in municipal taxes in 2024. A business valued at $1 million will pay $148 more.

Late penalty charges per Property Tax Penalty Bylaw are as follows:

- 6% of current levy July 1, 2024

- 6% of current levy August 1, 2024

- 12% of total owing March 1, 2025

Outstanding property tax balances from prior years will be subject to a 12% penalty effective March 1, 2025.

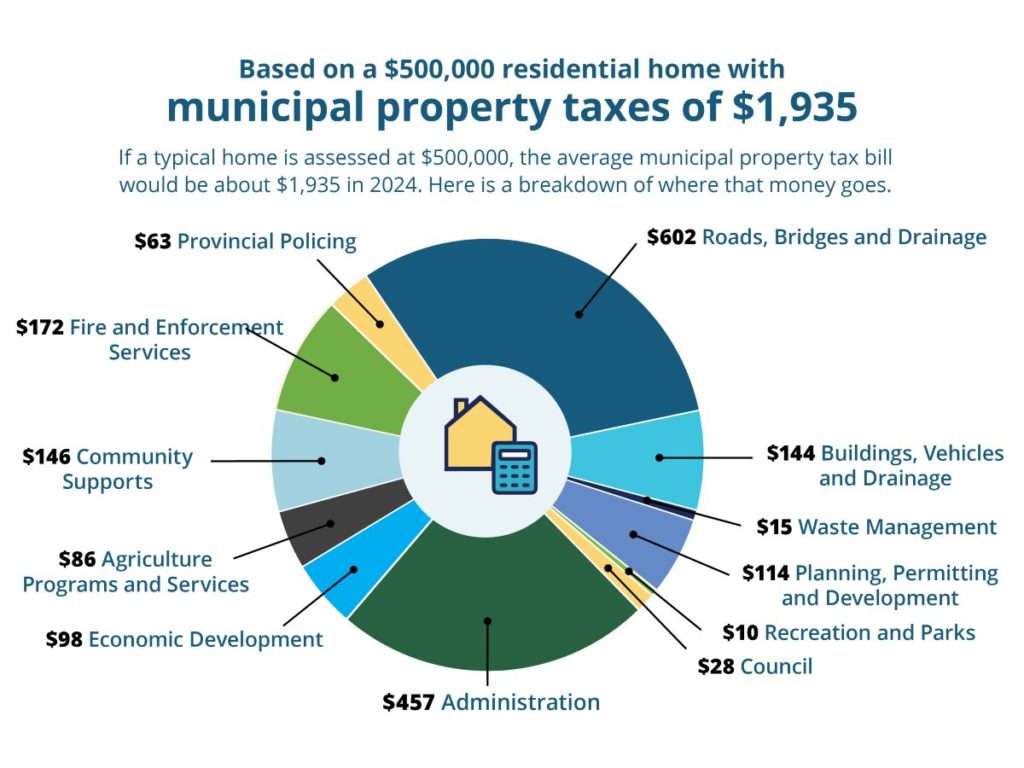

Where Your Property Taxes Go

2024 Property Tax Increase: 1.37%

Property taxes help pay for municipal services including bylaw officers, and fire protection, road maintenance, snow clearing, and investments in parks, roads, bridges, and drainage infrastructure. The municipal tax rate is determined each year by calculating the amount of money needed to operate the municipality and subtracting the revenues generated (for example, licences, grants, and permits). The remainder is the amount of money the municipality needs to raise through property taxes in order to provide the programs and services for the year.

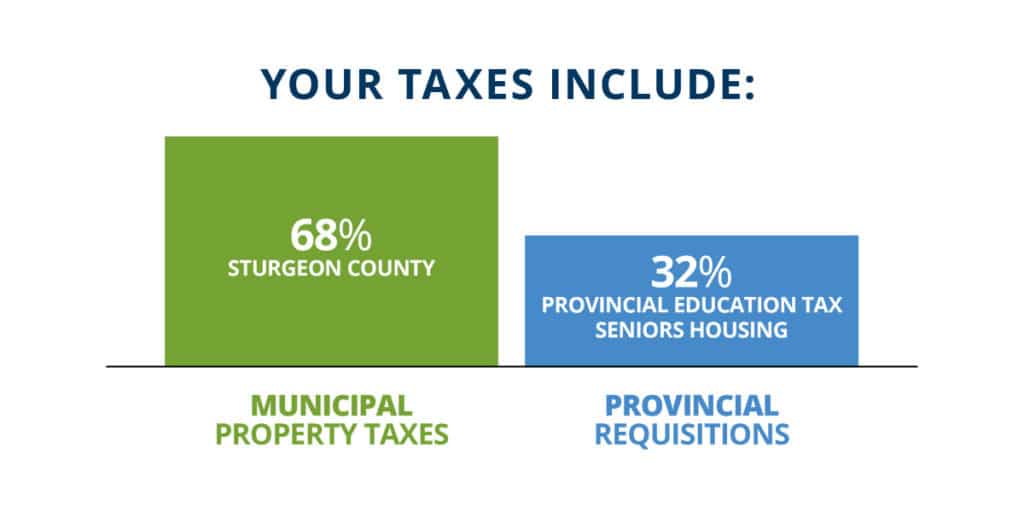

Your Property Tax Bill

Most of the property taxes you pay fund services provided by Sturgeon County. However, a portion of your taxes are used to fund regional services, like education and seniors’ care, and are collected on behalf of the Government of Alberta. The taxes charged by other authorities have increased substantially over the past decade. The County does not control the amount charged or how those amounts are distributed in the region.

Payment Options

Tax Installment Payment Plan (TIPP)

The Tax Installment Payment Plan allows property owners in Sturgeon County to pay their property tax in monthly installments rather than a single payment.

Pay in person at County Centre

Pay in person at County Centre:

9613 100 St.

Morinville, Alberta

T8R 1L9

Payment methods accepted:

- Cash

- Cheque or money order

- Make cheque or money order payable to Sturgeon County

- Sign and accurately complete your cheque, as Sturgeon County is not responsible for errors and/or omissions.

- Post‑dated cheques must be dated by the due date or earlier to avoid penalty.

- Debit card

Drop off – 24 hour deposit box

Located in front of Sturgeon County Centre

9613 100 St.

Morinville, Alberta

T8R 1L9

Deposit payment before midnight of the due date to meet the payment deadline. Do not deposit cash.

Make cheque or money order payable to Sturgeon County. Cheques (including post‑dated cheques) must be dated for the due date or earlier to avoid penalty. Sign and accurately complete your cheque, as Sturgeon County is not responsible for errors and/or omissions. Enclose the remittance portion of your bill(s) and write the property roll number(s) on your cheque.

Mail your cheque or money order to:

9613 100 St.

Morinville, Alberta

T8R 1L9

- Do not send cash in the mail.

- Make cheque or money order payable to Sturgeon County.

- Sign and accurately complete your cheque, as Sturgeon County is not responsible for errors and/or omissions.

- Enclose the remittance portion of your bill(s) and write the property roll number(s) on your cheque.

- The effective date of mailed payments received after the due date will be the date of the Canada Post postmark. The Canada Post postmark must be dated on or before the due date to avoid late payment penalties. If the Canada Post postmark is absent or illegible, the effective date of payment will be the date received.

- The imprint of a postage meter is not accepted as proof of the mail date.

Credit card

Third parties are not affiliated with Sturgeon County, and it is the responsibility of the taxpayer to understand and decide to accept or reject service fees and processing timelines to ensure Sturgeon County receives the payment by the due date.

Pay through your bank

Payments can be made in person or online through most financial institutions (banks, trusts, credit unions, etc.) and at Canada Post locations. It is the responsibility of the taxpayer to understand and decide to accept or reject service fees and processing timelines to ensure Sturgeon County receives the payment by the due date.

Property tax payments can be made through most chartered banks, trust companies, credit unions, and Alberta Treasury Branches. Know your bank’s policies regarding the effective date of payment. It’s important to pay at least three business days prior to the property tax payment due date to meet the payment deadline and avoid a late payment penalty. Please keep in mind that most bank transactions are based on Eastern Standard Time.

Add Sturgeon County as a payee

Search keywords: “Sturgeon County” and select the payee name closest to “Sturgeon County, tax”. Can’t find Sturgeon County as a payee or are unsure which payee to select? Contact your bank for more information.

The account number is the roll number on your property tax bill entered without spaces or dashes.